So if my email inbox, the comments on my Equity.Guru site, and what I've heard being discussed on the radio this week is right, an awful lot of you guys read my article last week on why you should think about investing in local businesses, rather than just buying sushi and phones and weed from them, and agreed to give it a shot.

This is a good thing. Apparently we've tapped into something here. After all, as discussed, it's not like putting your spare change into a mortgage is a thing anymore. Remember those days? Sweet nostalgia...

A lot of enthusiastic new investors have contacted me wanting to know how to actually open a share trading account and what to do with it once you've opened it, so I've set up a primer on my site that will walk you through that.

For those of you who are good to go, let's get to this week's update.

ARITZIA TO GO PUBLIC

Yep, iconic Vancouver-born fashion retailer Aritzia has announced it will roll out an IPO on the Toronto Stock Exchange some time in the near future, raising an undetermined amount of money for an undetermined amount of shares.

What does that mean for you, the casual Aritizia shopper and maybe sometime possibly investor?

You may be licking your lips, thinking, “I shop there all the time! I should totally buy stock!”

Before you bust out the vacation savings, let's think about this one for a second because the devil sure is in the details.

An IPO is an Initial Public Offering, which is what a company does when it would like to list itself for sale on a public stock exchange. Management puts out a prospectus that tells you the ins and outs of the deal and, if you want in, you send in a big cheque and the requisite forms and wait to see whether you get a piece. The hope is, enough people want in that the stock jumps up on debut.

And sometimes it does.

Personally, I'm not a fan of the IPO, because it always seems to me that someone else is getting way more value out of the deal before I'm even allowed in.

As an example, if you were one of the guys who lived next door to Mark Zuckerberg when he was in college and wrote him a cheque for $1000 back when Facebook had 18 users, a few years later, when the company IPOed and sold 421 million shares at $38 per share to the general public, you probably made a quintillion percent on your investment.

Along the way, a lot of employees and contractors and executives were given stock options and lumps of (initially worthless) private stock and, when the whole thing went public, investment bankers likely peeled off millions more. All those guys made bank, but you weren't one of those guys.

Then the company finally hit the stock market at a huge price and, as the average joes piled in, everything cratered. The stock dropped 50% over the next few months and it was the little guy that lost out on the deal.

Admittedly, those early guys who took a chance on an unknown, it's fair they should do well out of the deal. And the later buyers were buying a known quantity, so their risk was lower, but so was their potential upside.

The Aritzia IPO is, in my opinion, the worst possible deal for investors, because the only reason it's happening is so the majority owners of the company can cash out.

Yep, this deal is a stinker.

Aritzia is a big name in fashion retail, an industry that is falling on its ass and has been for a few years now. While Aritzia has 75 stores in Canada and the US, it says it wants many more and has big plans to grow.

But the IPO won't be done so Aritzia can amass a fat war chest to expand to horizons new. Nope, the company says it won't actually make any money out of the deal.

All the money raised will be buying previously private stock from the CEO, Brian Hill, and the US-based investment firm Berkshire Partners.

Why would they want to cash out, if the company is going to do so well going forward?

Perhaps because everything is not going to go so well going forward.

Let's look at the competition:

- Aeropostale: Closing all its stores

- Le Chateau: Closing 40 stores

- The Bay: Expanding, but under pressure

- Danier Leather: Liquidating

- H&M: Expanding, but under pressure

- Smart Set: Closed all stores

- Mexx: Closed all stores

- Urban Outfitters: Expanding

- Jacob: Closed all stores

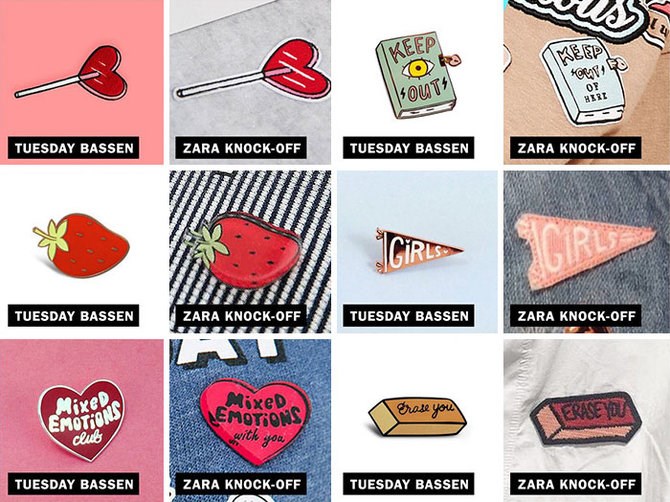

- Zara: Who gives a shit, they steal from indie designers and should be run out of town on a rail.

That's a harsh retail landscape, especially with Amazon destroying all comers online. If you were to be a betting person, you'd probably bet on Aritzia to have a rough time of it over the coming few years.

And if you owned all their stock today, you'd probably be looking for a bunch of brand-loving suckers to come in and take your future problems off your hands.

I just had the CEO of local direct sales children's wear startup Peekaboo Beans into my office for a chat (I mentioned that company's move to go public in my last column), and was much more impressed with that opportunity. She's built up to 1000 distributors/party planners who sell her products over the last few years, and they're having such a good time of it that, of the $1 million or so she's raised so far in going public, over $680,000 of that has come from people who sell Peekaboo Beans for a living.

I'm all for investing in companies that are at the beginning of their journey, rather than the end, and are actively growing behind people who are staking their future on the success of the brand.

Leave Aritzia to the suckers. Or, if you really want to buy in, maybe think about waiting for the IPO to land and for the the ensuing stock tumble. You'll get a much better deal.

Let's get to this week's picks for three local companies to watch, starting with one that's gone from zero to $1 billion in just a few years:

Company: LUCARA DIAMOND CORP. (www.lucaradiamond.com/)

Ticker: LUC.T

[youtube https://www.youtube.com/watch?v=D3IoOcj3ImQ]

Value: $1.6 billion

Share cost (at time of writing): $4.35

Share cost at start of 2016: $2.17

Investor return: 100.4%

What it does: Lucara has a diamond mine that churns out big fat rocks. Huge rocks. Tennis ball-sized diamonds. The kind of rocks that go on crowns, not promise rings.

Why I like it: You know how, when someone buys you an engagement ring, maybe the diamond has a carat or two and it cost $5k? Lucara is pulling diamonds out of the ground that measure in the hundreds of carats, even one recently that was measured in the thousands. I'm talking rocks so huge that they can't be sold through traditional channels and instead end up at large auction houses, where the winning bidders are often told, “Sorry, you need to add a zero to that.”

What's cool about them: They just had a big diamond auction and made so much cash that they handed $172 million back to shareholders. Yep, a $0.46 dividend for every share you own. Cheques falling from the sky!

What's not so cool about them: It's a diamond mine in Africa. I mean, you're not going to win the hearts of many telling people you own part of a diamond mine, but this is a long way from the blood diamond exploitation stories of old. Lucara is a squeaky clean set-up, and shareholders have doubled their money so far in 2016. I jumped in a few weeks ago and am up 20%.

Looking forward: There's no reason to think there won't be more fist-sized diamonds to come from this company, and fat dividends like the one that just landed. In terms of long term investments, this one is my favourite right now, especially in a world where the wealthy are increasingly looking for anything glorious to (over)spend their money on.

Any conflicts: I own some stock and will probably put my dividend cheque into buying more.

Company: NANO ONE MATERIALS (www.nanoone.ca/)

Ticker: NNO.V

[youtube https://www.youtube.com/watch?v=fMIdkFt19qE]

Value: $24.7 million

Share cost (at time of writing): $0.51

Share cost at start of 2016: $0.28

Investor return: 82%

What it does: Nano One is a nanotechnology company that has patented tech it says allows the production of low cost, high-performance battery materials in electronics, electric cars, and industrial storage. The company says they “can use lower grade raw materials and complete a production cycle in less than a day using a three stage process with up to 75% fewer steps [than competitors]. There is less handling, lower cost capital equipment, no waste solvents, 90-95% yield, many fewer failure points, higher safety and flexibility to run different material formulations in a controlled and sealed environment.”

Translated: If Tesla wants to lower the cost of a vehicle, that usually means lowering the cost of the battery, and Nano One tech can do that.

What's cool about them: If I was to zero in on one sector that I think is going to be to the next two decades what oil and gas were to the 80's and 90's, rechargeable battery tech is it. Nothing will be more important, as my Pokemon-bled cellphone battery can attest to. And Nano One is proving their tech at exactly the right moment in history to be important.

What's not so cool about them: The company is still at that place where you have to use words like 'can' and 'will' rather than 'has' and 'does', because they're still building a pilot plant designed to showcase the technology in a real world sense. That said, Canadian government tech funding agencies are backing that plan with over $2m committed in non-repayable grants approved to help pay for that plant, so it will be completed soon.

Looking forward: When that pilot plant is built and operating, not only can they begin the process of licensing their tech to car companies, battery companies, and phone companies, but they also become a prime takeover target. Think about it: If you're Tesla, do you pay these guys $80 million a year to help bring your battery costs down by $300 million, or do you just buy them for $100 million and make everyone else sweat?

Any conflicts: I not only own a boatload of this stock, but I also served as a consultant to them when they went public so do your own due diligence, but by all means do some.

Company: RewardStream

Ticker: REW.V

[youtube https://www.youtube.com/watch?v=_sYwQ9lYkmE]

Value: $19.3 million

Stock price (at time of writing) $0.40

Stock price at start of listing (August 4): $0.35

Investor return: 14%

What it does: RewardStream is a retail marketing referral program that allows companies like Wind, Boost Mobile, Johnson & Johnson, Koodo, BC Hydro, BC Lotteries, Purolator, Royal Bank, Rogers, and Virgin to encourage their customers to refer friends and family, in return for rewards.

The platform works through social media, mobile, email, online, even word of mouth, and they've facilitated over $300 million in new business for customers over the last two years. The company says for every ten referrals, they see eight of those become new customers, which is a lot better return than just about any other form of marketing.

What's cool about them: Besides the deep client list (Cisco, Nestle, First Calgary Financial..)? They just announced that former Apple mobile/e-commerce product development boss Ian Klassen has joined the company's advisory board. Over two decades in Silicon Valley, Klassen has led teams that created TV-based commerce applications for Amaon, developed the Zappos shopping app, and is an internationally recognized god when it comes to driving ecommerce dollars. This is not small news.

What's not so cool about them: This is a competitive space, with a lot of companies setting up their own referral programs in-house, so convincing a new client to come on board requires a long term partnership. Thankfully, they appear to be making that happen, and they're on track to bank $1.75m in revnues for the year so far.

Looking forward: This is the point where a company like RewardStream either gains traction and takes off, or struggles on until someone out-techs them. But with clients in 39 countries so far, as long as they can stay ahead of the development curve, REW has established a solid base to grow from.

Any conflicts: RewardStream has paid a consideration fee to V.I.A. to be featured in this space so potential investors are encouraged to do their own due diligence.

That's it for another week. Keep sending me your questions at my site, www.Equity.Guru and if you have a company that you like, that you'd like to see mentioned, contact me at Equity.Guru.

Thanks for reading.

-- Chris Parry