The tax is at a rate one per cent of a property’s assessed taxable valuable. The goal of the tax is to motivate homeowners to rent out homes they don’t live in full time. Vancouver’s current vacancy rate sits at .8 per cent. Photo Dan Toulgoet

The tax is at a rate one per cent of a property’s assessed taxable valuable. The goal of the tax is to motivate homeowners to rent out homes they don’t live in full time. Vancouver’s current vacancy rate sits at .8 per cent. Photo Dan Toulgoet

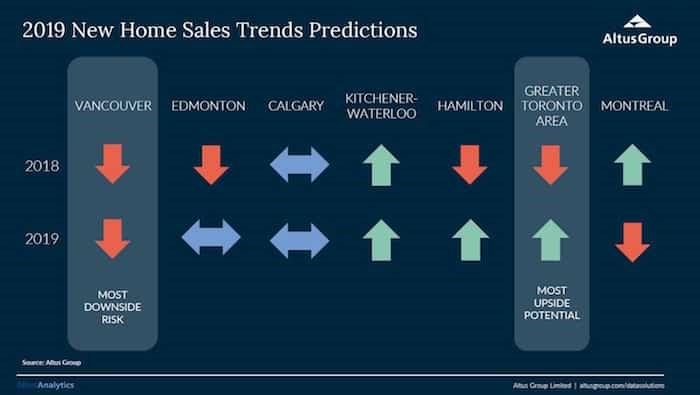

Sales of new-build homes across Metro Vancouver fell by 19 per cent in 2018, according to a report by real estate data company Altus Group issued January 9.

This is a further drop after new home sales fell in the metropolitan region by 33 per cent the previous year.

In its national new home outlook, Altus Group said, “The frenzied pace in the [Metro Vancouver] market has softened with the sales rate at launch moderating, while price growth has stopped and even pulled back in certain segments of the market. A key challenge that has become more apparent as of late has been the price sensitivity of consumers, with higher-priced projects, or those priced above the competition, experiencing below-average sales rates.”

Altus Group reported that the Metro Vancouver market had started 2018 as “the tightest of the markets examined, in terms of available new homes, with only 1.8 months of inventory.” However, it added, “[In 2018], new project launches, particularly along transit lines and in the Fraser Valley, have added much needed inventory and boosted the supply to 3.3 months' inventory – although this remains the lowest in the country.”

Source: Altus Group

Source: Altus Group

Altus Group is predicting that sales of new homes in Metro Vancouver will slip further in 2019 – although they will remain “at or close to the 10-year sales average for the market.”

The report authors wrote, “The Metro Vancouver market, which is currently exhibiting the most potential for downside risk, is expected to see a modest decline in sales volumes as consumers react to higher borrowing costs and developers react to escalating construction costs in the face of lower revenue opportunities.”

Source: Altus Group

Source: Altus Group