Never fear, Nana’s here. The VPD hopes the new online tool will help cut down on millenials falling prey to online scams. Courtesy VPD

Never fear, Nana’s here. The VPD hopes the new online tool will help cut down on millenials falling prey to online scams. Courtesy VPD

Millenials just can’t catch a break.

They’re being priced out of home ownership and having a hard time achieving work/life balance.

The recent surge in avocado prices can’t help either.

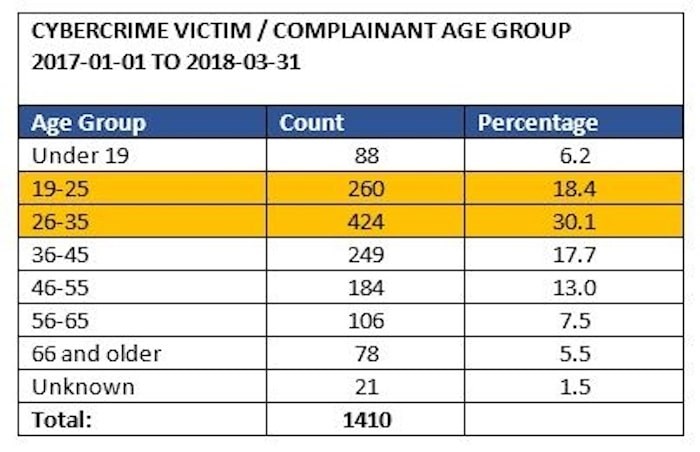

The news got worse Friday, as data released by the Vancouver Police Department shows that those between the ages of 19 and 35 represent half of all the victims of cyber crime in the city.

The data is gleaned from the period running Jan. 1, 2017 to March 31, 2018. About $1 million was lost due to fraud in those 15 months. Those between the ages of 26 and 35 were overwhelmingly duped the most often (30 per cent), followed by the 19 to 25 age bracket (18 per cent). Seniors 66 and older were defrauded the least often (5.5 per cent).

VPD stats show that Vancouver’s millenials were scammed more than any other age group in the city in the period running Jan. 1, 2017 to March 31, 2018.

VPD stats show that Vancouver’s millenials were scammed more than any other age group in the city in the period running Jan. 1, 2017 to March 31, 2018.

Indeed, the generation that grew up with the internet has become the largest group of people being fooled online.

“When it comes to online fraud, the traditional assumption that seniors are most often victimized doesn’t hold true,” the VPD said in a news release.

In response, Vancouver police have launched NANA Says, a new campaign aimed at raising awareness of online fraud with millennials.

The campaign plays on the unexpected, with fraud-aware Nana texting advice to her millennial grandchild. Examples of common types of fraud and tips to recognize and help prevent them will be shared in a series of online advertisements.

The VPD says the five most common online scams are:

1: Sale of goods, such as event tickets on sites like Craigslist

What to do:

*Ask the seller to meet you in your local police station to complete the sale.

* Only purchase event tickets from official re-sellers.

* Remember that if it sounds too good to be true, it is.

2: Residential fraud, where people pay deposits on apartments and find out the apartment is occupied and not available for rent.

What to do:

* Do not send money to anyone you have not met in person and/or for any property you have not seen in person.

* Visit the property and ask the occupant to confirm it is for rent.

* Ask for identification from anyone showing the property and, if possible, write down their licence plate if they arrive by car.

* Search for owner information in the Land Titles office to confirm you are dealing with the owner.

* Research the address online to ensure it is not a short-term rental.

Courier reporter John Kurucz’s experience with a rental fraud can be read here.

https://youtu.be/7WmbY6taJrk

3: Job opportunity fraud, like “work from home” schemes involving the processing of payments, which is actually money laundering.

What to do:

* Do not accept any unsolicited job offer or any “work from home” jobs that involved collecting debts or payments, or otherwise using your bank account to receive cheques.

* If someone contacts you from a company you’ve never heard of, do an online search and check their standing with the Better Business Bureau.

* If it sounds too good to be true, it is.

4: CRA scam, where people receive phone calls advising them to pay the taxes they owe or they will be arrested.

What to do:

*The CRA will not contact you by phone, text, or email and threaten arrest or to send the police.

* You cannot pay your taxes or “fines” by gift cards or by Bitcoin.

* Don’t trust your caller ID – scammers can fake the phone number they’re calling from.

* Get more tips from the Canada Revenue Agency.

5: Phishing emails or texts, which are unsolicited and seeking confirmation of personal information, like passwords.

* Your bank, credit union or credit card company will never contact you by phone, email or text and ask you for personal information, or to confirm your personal information.

* Never give your name, date of birth, address, account numbers, or passwords to anyone you don’t know via phone, email or text.

* Be cautious about opening attachments or clicking on links in unsolicited texts and email.

* Keep your computer security up to date.

If you suspect you’re being targeted or defrauded, document everything. Take screenshots and contact police.

@JohnKurucz