Former NHL player and North Vancouver resident Cameron Paddock has admitted to illegal insider trading and conduct abusive to B.C.’s capital markets, according to a settlement agreement with the B.C. Securities Commission.

Paddock is now largely barred from the securities industry for the next 10 years and has agreed to pay a $200,000 fine, the settlement states.

Paddock was one of four individuals named in a hearing notice that had been amended from the Bridgemark Group consulting case notice, dating back to November 2018.

Paddock and his company Rockshore Advisories Ltd. conceded misconduct “through a pattern of acquiring and then selling shares of companies for which he was acting as a consultant,” noted a commission press release Tuesday.

Rockshore bought free-trading shares from six public-traded junior companies through private placements via an exemption for consultants. The commission had alleged consultants, including Paddock, “performed little or no consulting work.”

Rockshore, “sold all of those shares in the market immediately or shortly after receipt of the issuer’s shares, often for a lesser share price than it paid to acquire the shares. However, Rockshore’s consulting fees offset the acquisition cost of its private placement shares,” the settlement stated.

As for the insider trading that contravened the B.C. Securities Act, Paddock and Rockshore admitted to trading company shares with knowledge of material information (that most of the funds raised in the private placements were paid out to consultants) that had not been publicly disclosed.

“As Rockshore’s director, Paddock authorized or permitted its contraventions of the Act,” stated the settlement.

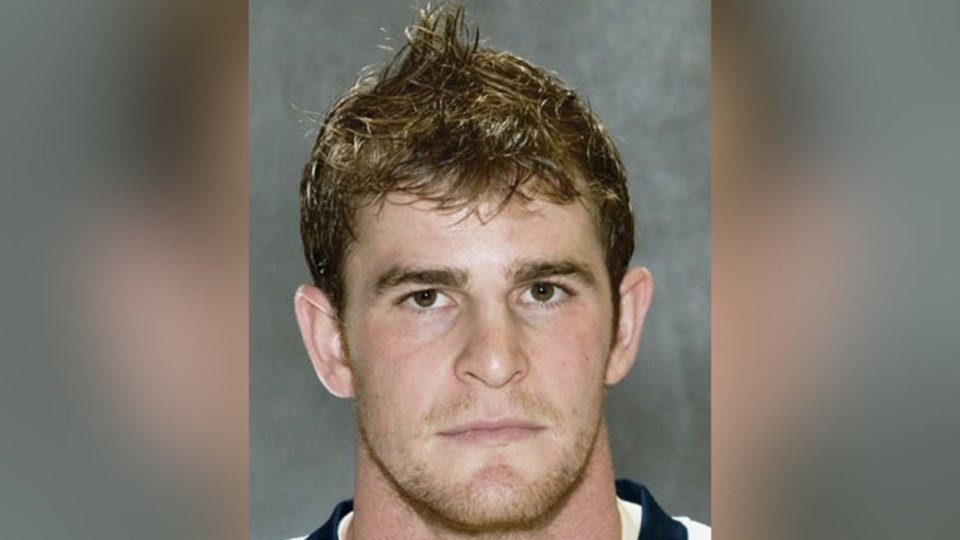

Paddock, 40, is a former professional hockey player, who rose through the ranks beginning with a four-year stint as a young man with the Kelowna Rockets of the Western Hockey League. Drafted by the Pittsburgh Penguins in 2002, he spent most of his time in the NHL farm leagues until a 16-game stint with the Blues during the 2008-2009 season. He is presently the director of hockey for the North Shore Winter Club. Paddock declined to comment on the settlement other than to say he was “surprised” a reporter was interested.

Paddock is now barred from becoming a director or office of any public company or registered entity with the commission; he is also barred from promotional and consulting activities and trading securities unless for personal reasons and through a registered dealer who has a copy of his agreement and orders.

Paddock is the second of four B.C. residents to admit to illegal insider trading after initially facing a hearing alongside dozens of consultants and their respective companies the commission dubbed the Bridgemark Group.

In April 2021, the commission discharged most of the consultants from the original hearing notice, leaving just four key alleged conspirators to face administrative charges of illegal insider trading and conduct contrary to the public interest in an amended hearing notice.

The commission stated in its amended hearing notice, there was collectively $50.8 million worth of shares purchased, and $42.9 million in consultant fees issued, via nine firms traded on the Canadian Securities Exchange, in the span of seven months in 2018.

Paddock’s agreement shows he purchased $3.2 million of shares in two unnamed companies, sold $2.5 million and received $972,500 in consulting fees — transactions in which he had a special relationship with the company and traded with undisclosed knowledge.

Also admitting to illegal insider trading, last January, was co-respondent Robert John Lawrence, whose company Tavistock purchased $625,000 worth of shares via arrangements similar to Paddock’s, as described by the commission.

Since 2019, the commission has also settled with executives from four companies, upon their admissions that they made misrepresentations in 2018 with respect to consulting contracts and private placements. The commission has hearings scheduled for three other companies.

Paddock made his admissions ahead of a lengthy hearing that is scheduled to commence Sep. 29 and last into next year.

The original amended hearing notice lists (aside from Paddock and Lawrence): Anthony Kevin Jackson, Jackson’s BridgeMark Financial Corp., Jackson’s financial service firm Jackson & Company Professional Corp., Justin Edgar Liu, and Liu’s Lukor Capital Corp. and Asiatic Management Consultants Ltd.

Jackson and Liu are alleged to have conducted themselves contrary to the public interest as company directors and performed illegal insider trading. Those administrative allegations (from the commission’s executive director Peter Brady) have not been proven before a panel of independent commissioners.