The B.C. government appears to continue to accept the real estate industry’s argument that rapid home price increases in Vancouver are a supply and demand problem, not the result of wealthy people from China seeking a safe haven for their money.

But two Vancouver-based economists who specialize in real estate say it’s clear that the capital outflow phenomenon is having an effect on the city’s real estate market.

“It’s very hard to think that anything other than outside capital flows are driving unaffordability right now,” said Tom Davidoff, a professor of economics at University of British Columbia’s Sauder School of Business.

“These housing prices do not make sense as a live and work proposition. They make sense as bags of cash hiding out in real estate looking for a safe return.”

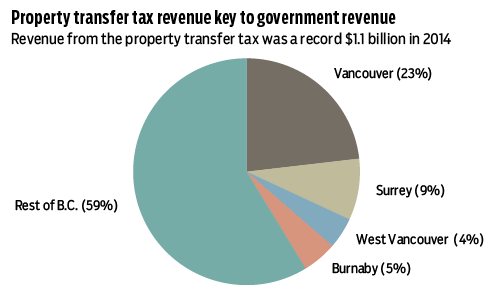

The province’s 2016 budget unveiled a suite of measures designed to help put home ownership within the reach of more people. They included a property transfer tax (PTT) exemption for buyers of new homes that priced at up to $750,000; a PTT increase to 3 per cent from 2 per cent for properties valued at more than $2 million; and a requirement that property buyers self-report their nationality when they register their property.

Currently, Canada does not track data on foreign owners of real estate, and the Ministry of Finance has relied on information from the real estate industry that foreign investors represent a minor part of the real estate market.

In budget briefing documents, the province downplayed the effect foreign investment is having on Vancouver’s housing market, saying that the Lower Mainland has historically had high housing prices and supply constraints and demand from brisk population growth are behind the price increases.

Jon Stovell, president of Reliance Properties and a director of the Urban Development Institute, said lack of supply was the only answer to the question of why home prices have risen to such dizzying levels.

“The public is looking for a smoking gun with respect to housing affordability, like shadow flipping or offshore buyers or speculators,” he said. “But it’s not that; it’s just straight out supply.”

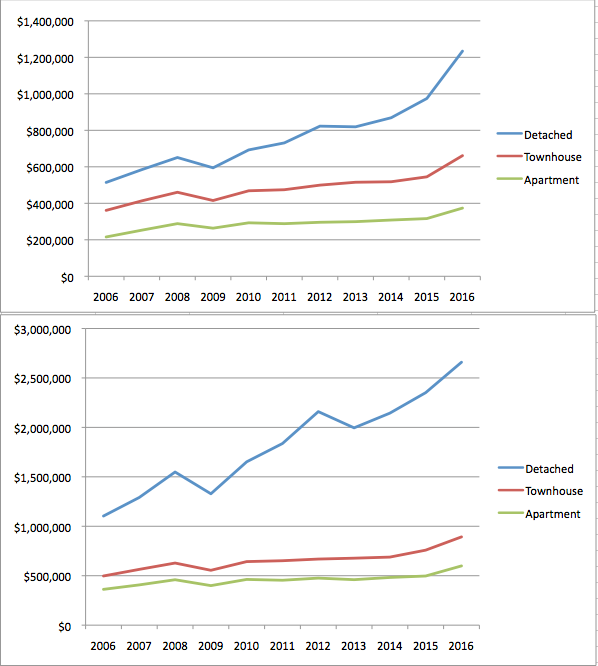

The theory that Vancouver’s land constraints and population increase were the main factors behind the price increases made sense until prices jumped sharply — by around 20 per cent — during 2015, said Tsur Somerville, another Sauder professor.

“The only thing that you can point to that’s changed are two things: one, the lowering of the Canadian dollar and two, a massive change in the official currency reserves in China,” Somerville said, referring to a sharp increase in wealthy individuals and companies trying to get money out of China in response to that country’s economic slowdown.

Singapore and London recently increased tax on non-residents and the United States is investigating the use of shell companies to hide real estate transactions, Somerville said. B.C.’s inaction on the issue means the region will attract those seeking a safe money haven.

The PTT exemption for new homes could be beneficial in areas of the province that don’t have as much demand for housing, said Davidoff, and it will benefit home builders. But in Metro Vancouver, where developers can’t build projects fast enough and where municipal fees haven’t slowed the pace of development, the policy is unlikely to have much effect. Tax exemptions are a policy a government might turn to stimulate a sluggish housing market, like the one the United States experienced following the 2008 financial crisis, he said.

NDP MLA David Eby questioned how accurate the data collected would be, given that several media investigations have shown realtors bending the rules for their wealthy clients.

“I was hoping to see more than just a form for rogue realtors to check a box,” he said.

“There’s an issue with compliance with realtors encouraging clients to not accurately declare their residency.”

Raising the PTT on homes worth more than $2 million is a positive move, Somerville said, because it makes the tax more progressive.

But Stovell said the increase will be passed on to new condo buyers because much new development in Vancouver now requires land assembly, a process of slowly buying single-family lots, many of which are now priced at over the $2 million mark. The assembler then re-sells those lots to the developer — meaning the PTT can be paid three or four times, with the land value increasing with each sale.

For one downtown project he is working on, Stovell calculated the PTT increase would add around $2,500 to each condo unit.

Davidoff and Somerville were part of a group of academics at UBC and Simon Fraser University who developed a proposal to charge higher property tax if property owners don’t live in the property or don’t report income in Canada.

Despite the province’s public rhetoric, government seems to be seriously considering the proposal; government staff will be meeting with Davidoff next week.

“They must be aware that the dominant issue is this huge inflow of people looking to park cash in Vancouver real estate,” Davidoff said.

@jenstden

For more business news go to biv.com