With the extended deadline just over a week away, fewer than 4,000 homeowners have yet to submit their Empty Homes Tax declarations. The original deadline was Feb. 2, but that was moved to March 5.

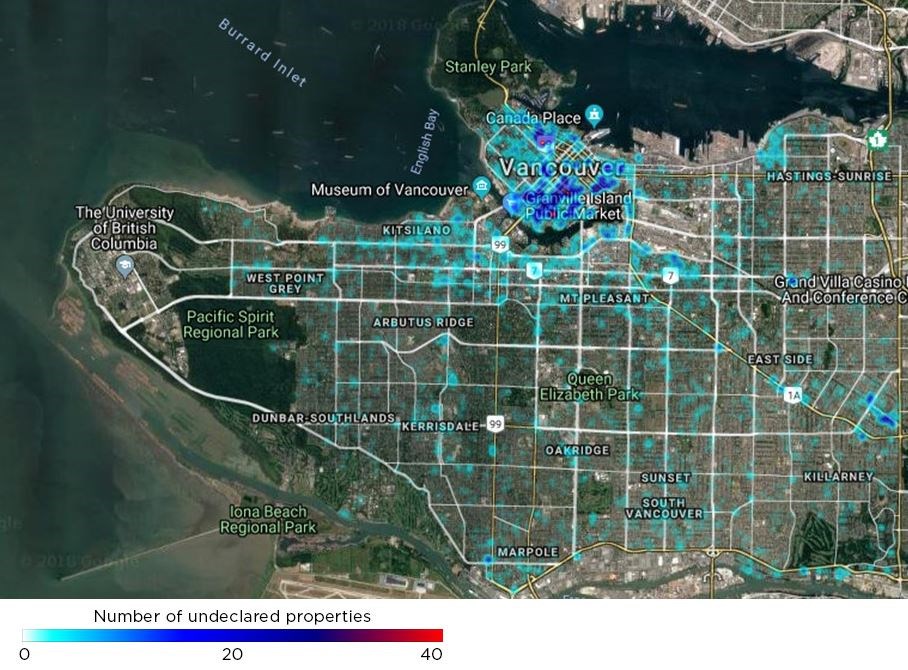

The highest number of undeclared properties are in downtown Vancouver — in Yaletown, followed by Coal Harbour and the West End, according to the City of Vancouver.

To date, about 182,000 — 98 per cent — of residential property owners have completed the declaration.

Those who fail to do so by the deadline could face fines and penalties.

The city estimates there are more than 25,000 empty or under-utilized homes in Vancouver, which could help house those having trouble finding affordable homes to rent.

“With a near-zero vacancy rate in Vancouver, our key goal is to shift empty or under-used housing into the rental market,” Mayor Gregor Robertson said in a press release issued Feb. 22. “The City has done extensive advertising and notifications about the Empty Homes Tax for more than a year — all homeowners should know that they have to file a declaration, or their homes will be considered empty by default.”

If homeowners don’t fill out a declaration, their property will be deemed vacant and subject to the tax and a $250 penalty. The tax is one per cent of the property’s 2017 assessed taxable value.

Owners of properties deemed vacant will receive a vacancy tax notice and a bylaw notice for $250 in mid-March. Payment of the tax will be due by April 16 or a five per cent late penalty will be applied.

An audit program for the Empty Homes Tax is underway to encourage compliance with the new tax, according to the city. The program uses a risk-based approach, as well as random audits, which is in line with best practices of provincial and federal taxation authorities.

Residential property owners will be notified by letter if their property is selected for audit and will be required to provide evidence verifying their property status declaration. Net revenues from the tax will be reinvested into affordable housing initiatives in the city.

Residential property owners can submit their Empty Homes Tax declarations in the following ways:

- Online at vancouver.ca/eht-declare. The online declaration process takes most people a few minutes to complete.

- In person at city hall. Staff are available to assist with online declarations. City hall regular hours are 8:30 a.m. to 5 p.m.

- Over the phone by calling 3-1-1. Residential property owners can declare by calling 3-1-1 between 7 a.m. and 10 p.m. daily. Outside of Vancouver, call 604-873-7000. Translation services are available at 3-1-1.

- Residential property owners can receive technical and information support for submitting their online declaration at any Vancouver Public Library location. For opening hours and locations visit vpl.ca/hours-locations.