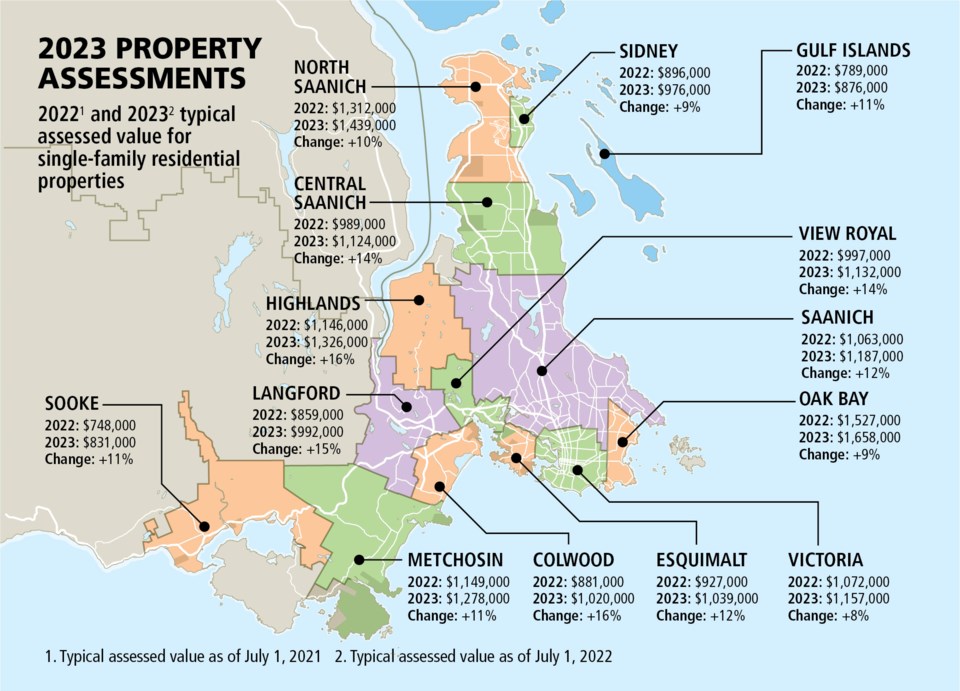

Most Greater Victoria homeowners will see property assessments that are eight to 20 per cent higher than last year as assessment notices start landing in mailboxes this week.

With a few exceptions in the central and north Island areas, owners on the rest of the Island can similarly expect a 10 to 20 per cent increase, said Vancouver Island deputy assessor Jodie MacLennan, who cautioned that 2023 assessments are based on what homes could have sold for as of July 1, 2022, before market values began trending downward.

B.C. Assessment sent out more than 384,000 notices to property owners on Vancouver Island.

The largest increase in assessed value for typical single-family homes in Greater Victoria was in Colwood and Highlands, which rose by 16 per cent to $1.02 million and $1.32 million respectively. Victoria saw the typical valuation increase to $1.15 million, an eight per cent rise from last year.

The biggest increases for strata properties were in View Royal, which saw a 20 per cent jump to $633,000 for a typical condo or townhome year-over-year.

In the central Island region, Lake Cowichan saw the largest increase year-over-year, as the typical assessment rose 23 per cent to $642,000, while in the north Island, Sayward saw values for a typical home increase by 28 per cent to $393,000.

The Island’s total assessment value increased to $386 billion from about $342 billion last year. About $4.78 billion of the region’s updated assessments is from new construction, subdivisions and the rezoning of properties.

The assessment is the estimate of a property’s market value as of July 1 and physical condition as of Oct. 31.

B.C. Assessment said changes in value can vary greatly from property to property. To determine value, assessors take into account current sales in an area as well as the size, age, quality, condition, view and location of a property.

With average property values in the province increasing by 12 per cent, the provincial government announced Tuesday it is boosting the homeowner grant threshold to $2.125 million for this year.

Last year, the threshold was $1.975 million. Homeowners whose properties are assessed at or below that threshold qualify for up to $570 for the basic homeowner grant, and as much as $845 for those age 65 or older.

The government said in a statement that raising the threshold means about 92 per cent of residential properties will be eligible for the grant.

MacLennan said big changes in assessed value do not necessarily mean higher property taxes, since taxes are affected only by how the assessment changes relative to the average change in that community — a higher-than-average increase might bringer higher taxes.

Anyone who feels their property assessment does not reflect market value as of July 1, or sees incorrect information on their notice, is advised to contact B.C. Assessment. If they are not satisfied after that, they can submit an appeal.

Property assessment review panels, which are independent of B.C. Assessment, are appointed annually by the province and meet between February and March 15 to hear complaints.

The deadline to file an appeal of an assessment is Jan. 31.

B.C. Assessment said more than 98 per cent of property owners accept their property assessments without a review.

The residential property in the capital region with the highest assessment was once again James Island, at $61.24 million, a jump from the $54.7 million it was valued at last year. James Island ranks third in the province for assessed value. At the top of the list is a $74-million waterfront mansion and compound on Vancouver’s Point Grey Road owned by Lululemon founder Chip Wilson.

The most valuable single-family home in the capital region remains 3160 Humber Rd. in Oak Bay, assessed at $16.8 million — a drop from the $17.875 million valuation it was given last year.

The total value of real estate on the provincial roll is more than $2.72 trillion, up from $2.44 trillion last year. New construction, rezonings and subdivisions accounted for $33.52 billion.

There were more than 2.16 million properties on the 2023 roll, an increase of about one per cent compared to last year.

B.C. Assessment’s website includes more details on assessments, property information and trends.

The website also provides self-service access to an assessment search service for those who cannot wait to get their assessment in the mail.

>>> To comment on this article, write a letter to the editor: [email protected]