What happened: Federal party leaders addressed the country on Saturday as the House of Commons resumed for an extraordinary session to debate and vote on a wage subsidy bill to support Canadian businesses, non-profits and charities.

Why it matters: Prime Minister Justin Trudeau called the bill Canada's largest economic policy since WWII. Government representatives confirmed earlier in the day that all federal parties had agreed to the bill.

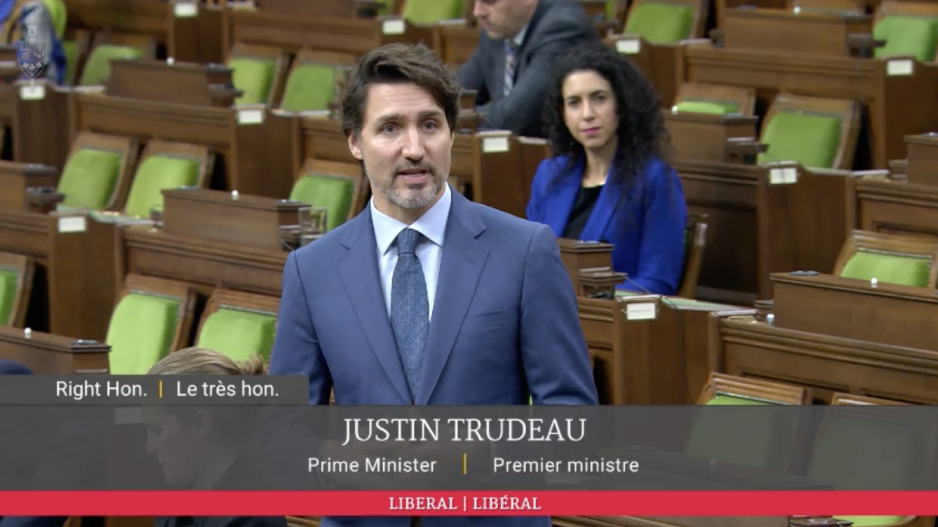

Ahead of a historic debate on extraordinary measures to support Canadian businesses and charities, Prime Minister Justin Trudeau drew parallels between WWI and the global coronavirus pandemic.

“The frontline is everywhere. In our homes, in our hospitals and care centres, in our grocery stores and pharmacies,” he said from a relatively empty House of Commons.

Trudeau spoke about the Canadians who – more than a century ago – took Vimy Ridge and fought for a better and safer future. He spoke about Canada's "greatest generation," which grew up during the Great Depression and fought in WWII.

“The last members of this greatest generation live in nursing homes and long-term care facilities. They’re in their small apartments and the homes they built so long ago with their own hands. They are the ones most threatened by this disease. They fought for us all those years ago and today, we fight for them.”

The House of Commons reconvened Saturday for an extraordinary session to debate and vote on a wage subsidy bill that will cover up to 75% of employee wages for eligible businesses, non-profits and charities. The latest version of the proposed legislation defines eligible organizations as those that experienced at least a 15% year-over-year decline in revenue in March, April and May due to the spread of COVID-19 and government measures to flatten the curve. Firms have the option of comparing their revenue in March, April and May to their average revenue earned in January and February.

Earlier on Saturday, House of Commons government leader Pablo Rodriguez confirmed that all parties had agreed to the bill.

In his opening remarks, New Democratic Party (NDP) leader Jagmeet Singh said that the NDP will support the bill and a unanimous consent motion, but he added that too many Canadians may not meet criteria for various government benefits and programs.

"We should not leave here without knowing and without guaranteeing that all Canadians who need help get that help," he said. "We're not done yet. The current system discourages people who need help from applying because they still have some income or they don't meet all of the criteria."

Singh has called on Trudeau's government to drop all criteria and eligibility requirements from programs such as the Canada Emergency Response Benefit.

Like Singh, who said the federal government has reacted too slowly to the COVID-19 crisis, Conservative Party of Canada leader Andrew Scheer challenged how the Liberal Party of Canada has addressed the concerns of Canadians and businesses across the country.

Without directly challenging the amount of money the federal government is funnelling into wage subsidy, employment insurance and benefit programs, Scheer said that it will take "years of discipline" to balance the Canadian economy once the crisis is handled.

"The sacrifices of Vimy are not forgotten," said Green Party of Canada leader Elizabeth May.

"Tt's quite true that a lot of the things that we wanted weren't in the first version of the bill," she said. Initially, the wage subsidy program would have covered up to 10% of an employee's wages and excluded large companies. Only organizations that experienced at least a 30% decline in revenue year-over-year would have been eligible.

"There's a real sense of all hands on deck, and I want Canadians to know that."