Vancouver-based First Mining Gold (TSX: FF) has released positive results for the preliminary economic assessment (PEA) of its Duparquet gold project located in the Abitibi region of Quebec about 50 km north of Rouyn-Noranda. The study gives the project a pre-tax net present value (NPV) with a 5% discount of $1.07 billion and a pre-tax internal rate of return (IRR) of 24.9%.

Looking at the after-tax numbers, Duparquet has an NPV with a 5% discount of $588 million and IRR of 18.0%.

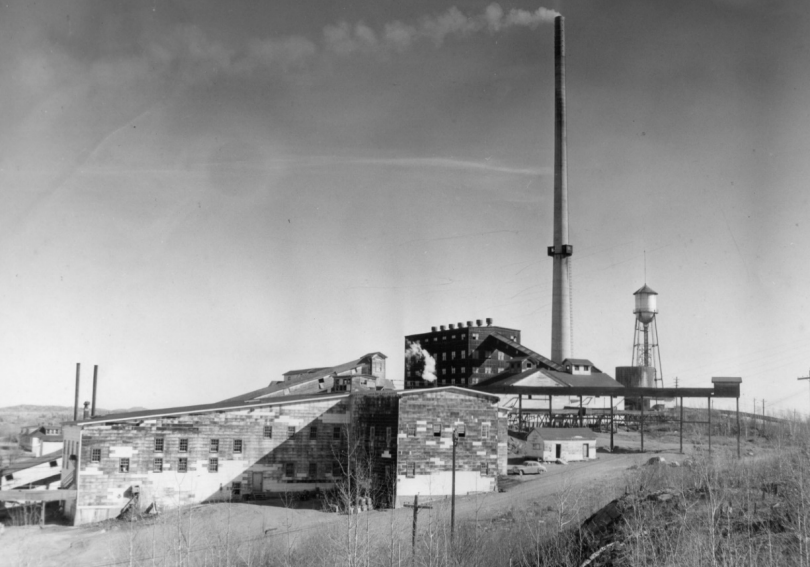

The PEA results support development of a 15,000-t/d open pit and underground operation. It includes the Beattie, Donchester, Central Duparquet, and Cumico claim blocks, but does not include the Pitt and Duquesne deposits.

The open pit resource estimate covers 163,700 measured tonnes at 1.37 g/t (7,200 oz. gold), 59.4 million indicated tonnes at 1.52 g/t (2.9 million oz. gold), and 34.6 million indicated tonnes at 1.16 g/t (1.2 million oz. gold).

The underground resources include 5.5 million indicated tonnes at 2.26 g/t (399,300 oz. gold) and 16.8 million inferred tonnes at 2.59 g/t (1.4 million oz. gold).

Additionally, the tailings have 19,000 measured tonnes grading 2.03 g/t (1,300 oz. gold) and 4.1 million indicated tonnes at 0.93 g/t (3.4 million oz. gold).

The average 11-year life of mine annual gold production will be 233,000 oz. per year with an all-in sustaining cost of US$976/oz. Total production is projected to be 2.5 million oz. of gold.

First Mining has put initial capital costs at $706 million for the open pit. Sustaining costs and underground development will be $738 million. The after-tax payback period will be 4.8 years (3.8 years pre-tax).

Conventional open pit mining will begin in year one at a rate of 10,400 t/d. At the same time underground development will begin. Underground long hole mining is expected to begin in year two at a rate of 3,500 t/d. The peak mining rate for both mines will be 12,670 t/d in year eight.

The mill is designed to treat 15,000 t/d of ore plus reprocessing existing tailings. The flowsheet consists of primary crushing, SAG and ball mill grinding, rougher and cleaner gold flotation circuits, concentrate dewatering and loadout facilities. Flotation tailings will be thickened to produce for storage onsite.