The Vancouver Canucks have just a handful of pending free agents heading into the 2022 offseason and they’re mostly at the bottom of the lineup. The one exception, however, is a big one: Brock Boeser.

The 25-year-old winger will be a restricted free agent, which means the Canucks hold his sole negotiating rights. Theoretically, that means the Canucks could take their time with negotiating his contract this summer but there’s a significant pressure point to get a deal done sooner rather than later.

Because of the structure of Boeser’s contract, his qualifying offer — a one-year deal meant to maintain negotiating rights for an RFA — will be a whopping $7.5 million. That would land Boeser in the top 10 cap hits in the NHL among right wingers.

For the record, Boeser was 27th in the NHL in points among right wingers this past season. To be fair, last season, when he led the Canucks in scoring, he was fifth in the NHL.

It’s obviously in the Canucks’ best interests to get Boeser signed at a lower cap hit but Boeser always has the option of simply accepting his qualifying offer when it comes by the July 11 deadline. A one-year, $7.5 million contract might be very tempting, particularly since it would take him straight back to restricted free agency next offseason where he could sign another one-year, $7.5 million qualifying offer and take it to unrestricted free agency.

Essentially, that’s what the Canucks are competing against in their negotiations with Boeser and his agent — a two-year, $15 million contract.

What the Canucks can offer Boeser is the security of a multi-year deal, the value of which should be clear to a player that saw his points drop off this past season and lost significant time due to injuries in previous seasons. There’s also the familiarity of playing in Vancouver with his Canucks’ teammates, with whom he’s grown some significant friendships over the past several years.

The Canucks would like to get a deal signed before the July 11 deadline for qualifying offers and it needs to be more tempting to Boeser and his agent than a pair of one-year, $7.5 million contracts. But what would be a fair contract offer to a player like Boeser?

Contract projections predict a five-year deal for Boeser

A contract projection model, like the one from Evolving Hockey, is one way to answer that question. The model uses a variety of statistics along with past contracts to predict both the term and cap hit of future contracts.

For Boeser, the prediction from Evolving Hockey is a five-year contract with a cap hit of $6.497 million, with the second most-likely result a four-year contract with a cap hit of $6.342 million.

A five-year deal would buy up three years of unrestricted free agency for Boeser. Generally speaking, including potential UFA years in a contract increases the cap hit, as each of those years represents taking away an opportunity to potentially make more money by going to free agency where multiple teams can enter a bidding war.

More recent buzz suggests that Boeser and the Canucks are more likely to agree on a three-year deal, which would buy up just one UFA year.

The benefit for the Canucks would be a lower cap hit for those three years as general manager Patrik Allvin looks to quickly turn the team into a legitimate contender. The benefit for Boeser is that he would be betting on himself that he can earn a significant raise in three years’ time.

Evolving Hockey’s contract projection model predicts a $6.335 million cap hit on a three-year deal for Boeser, which is barely different from the four-year projection.

So, the cap benefit to the Canucks might not be significant on a three-year deal, but Boeser’s camp holds a lot of leverage because of the $7.5 million qualifying offer. That means Boeser and his agent can push for the shorter-term deal that is more beneficial long-term for Boeser.

Contract comparables for Boeser are inexact

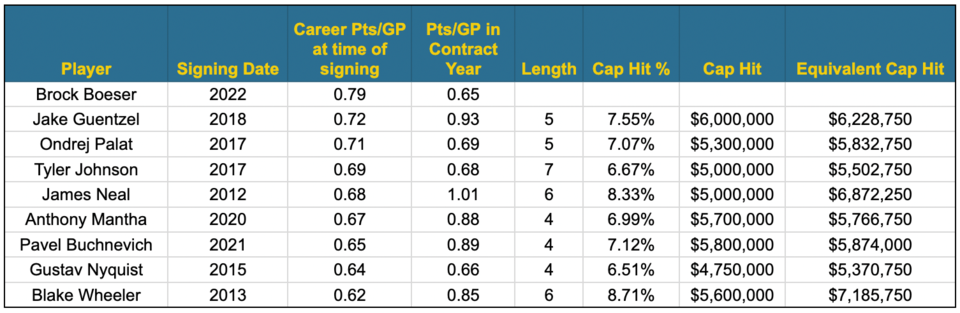

Let’s look at some real-world examples, specifically looking at players in the past decade who signed contracts at the same age as Boeser with similar production.

That’s easier said than done as it’s unusual for a player like Boeser to have the worst season of their career in a contract year. The NHL is very much a what-have-you-done-for-me-lately league and, while he once again surpassed the 20-goal mark, it wasn’t much of a progression from previous seasons and he had the lowest points-per-game rate of his career.

His struggles this past season are understandable given that off the ice he was privately dealing with the declining health of his father. It’s something the Canucks will need to take into account as they enter negotiations.

Boeser has 256 points in 324 career games for a career points-per-game of 0.79. This past season, however, he had 46 points in 71 games for a points-per-game of 0.65. That’s a rare combination. Most players tend to out-score their career points-per-game at the age of 24.

Here are eight players with at least some similarity to Boeser in terms of their signing age and their points-per-game, via CapFriendly. As you can see, Boeser has a higher career points-per-game out of all of these similar players but has the lowest points-per-game in his contract year.

The truth is, there weren’t many comparable wingers with a higher points-per-game than Boeser. Of those few, they all produced a lot more than Boeser in his contract year.

There’s Alexander Semin, for example, who had 0.88 points per game at the age of 25 when he signed his new contract, but he was coming off a season when he scored 34 goals and 79 points in just 62 games and was also a point-per-game player in the playoffs.

Another example is Mark Stone, who had similar career numbers — 0.81 points per game — but was coming off a better-than point-per-game season with 62 points in 58 games to go with Selke-caliber defence.

Comparable players to Boeser rarely sign for fewer than four years

One of the closest matches in terms of career points-per-game and contract year points-per-game is Ondrej Palat. When he signed in 2017, he had 0.71 points-per-game in his career but had just 0.69 points per game in his contract year.

Palat earned a five-year contract worth $5.3 million per year, which is the equivalent to just over $5.8 million against next year’s salary cap.

Palat’s Tampa Bay Lightning teammate Tyler Johnson is another comparable player, who got a seven-year deal with a lower cap hit.

Anthony Mantha and Pavel Buchnevich are interesting comparables. While their contract year production was much higher than Boeser’s, it’s actually very similar to Boeser’s production in his previous season, when he put up 0.88 points per game.

Both Mantha and Buchnevich got four-year deals worth around 7% of the salary cap, which comes out pretty close to $5.8 million.

Boeser’s goalscoring — something that comes at a premium in the NHL — along with his better career numbers would mean a higher cap hit than $5.8 million would be in order.

One thing that all of these comparable players have in common, however, is a contract length of at least four years. Players of Boeser’s quality rarely sign for three years or fewer.

Evolving Hockey’s contract model projects just a 9% chance of a three-year deal for Boeser, which speaks to how rare such deals are for players of his caliber. A one-year deal is even less likely at just 3%.

For Boeser, however, those two outcomes are a lot more likely than the model would suggest. It seems probable that Boeser’s next contract will either be a three-year deal worth a little bit south of $6.5 million or a one-year deal for $7.5 million.